Empowering SMB Owners with Free Credit Reports

At Fundera, we believe that by educating small business owners in their financial decisions can lead to long-term success. This project is the team's first attempt at empowering small business owners with free business and personal credit reports.

At Fundera, we believe that by educating small business owners in their financial decisions can lead to long-term success. This project is the team's first attempt at empowering small business owners with free business and personal credit reports.

At Fundera, we believe that by educating small business owners in their financial decisions can lead to long-term success. This project is the team's first attempt at empowering small business owners with free business and personal credit reports.

At Fundera, we believe that by educating small business owners in their financial decisions can lead to long-term success. This project is the team's first attempt at empowering small business owners with free business and personal credit reports.

ROLE

User Researcher

Product Designer

TEAM

Antonio Felguerez — Software Engineer

Brayden McCarthy — VP Strategy

Vikas Sood — VP Product

Rosalie Forman — Growth, Business Operations

Annie Harvey — Account Manager Lead

Kevin Twohy — Freelance Product Designer

STATUS & RESULTS

Launched in July 2017. As of December 2017, we’ve had over 3K Personal Credit and 3.4K Business Credit Sign Ups.

Learn more at fundera.com

GOAL

PROBLEM

Empowering Small Business Owners with Free Credit Reports

After 2.5 years of focusing on the SMB loan product offering, the team decided to make a long-term strategic bet on giving our customers access to their personal and business credit reports.

As a first step, we aimed to increase confidence in Fundera and our product offerings through a credit reports tool that offers personal and business credit reports to our funded customers. This feature could potentially unlock an experience that shifts our product experience from strictly transactional to recurring engagement.

CHALLENGE

Validating Initial Assumptions

The challenge was two-fold:

- To validate the assumption that funded loan customers are logging back in and opportunistically looking to find more loan options by stumbling upon their business and personal credit reports.

- To introduce user feedback as an integral part of the product design and development process.

UNDERSTANDING CONTEXT

Credit & Lending

Credit & Lending

We were interested in learning the following:

- How familiar are small business owners with personal credit and business credit, especially in the relationship to loan financing?

- Would small business owners trust Fundera to provide personal and business credit report information?

- Ultimately, would they find value and continue using this product to either learn more about their credit scores, apply for loan financing options, or both?

IDENTIFYING PAIN POINTS

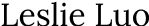

The initial prototype

The initial prototype

The initial prototype

I joined the project at the implementation phase of the first prototype the initial team built. However, we pivoted its purpose by utilizing it as a working prototype for user feedback.

I joined the project at the implementation phase of the first prototype the initial team built. However, we pivoted its purpose by utilizing it as a working prototype for user feedback.

I joined the project at the implementation phase of the first prototype the initial team built. However, we pivoted its purpose by utilizing it as a working prototype for user feedback.

I joined the project at the implementation phase of the first prototype the initial team built. However, we pivoted its purpose by utilizing it as a working prototype for user feedback.

I joined the project at the implementation phase of the first prototype the initial team built. However, we pivoted its purpose by utilizing it as a working prototype for user feedback.

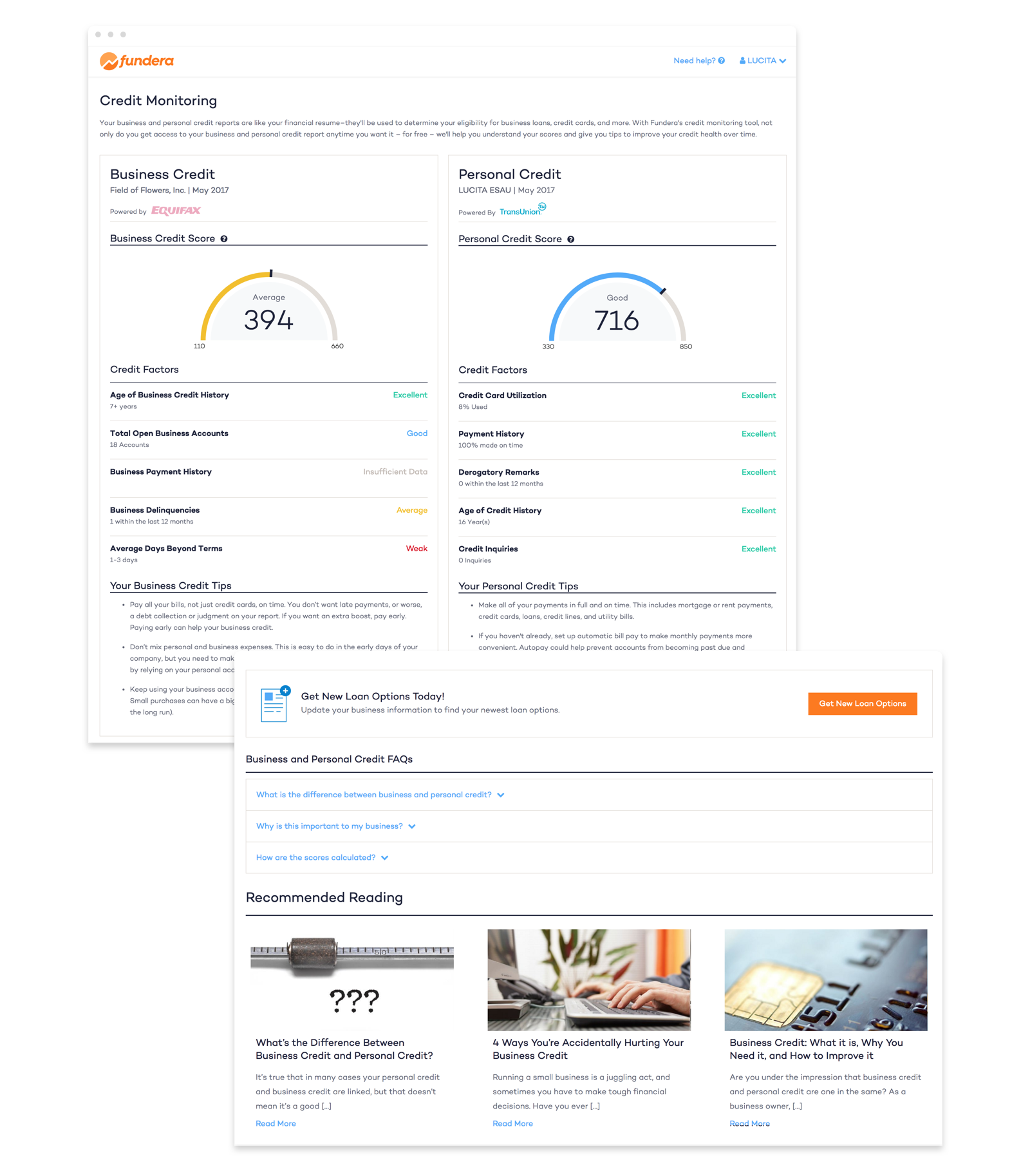

Learnings

After ten remote user interviews and two prototype iterations in between users expressed the following:

Recommendations

Depending on the level of familiarity, there were two distinct behaviors: Folks more familiar look for actions to take immediately and folks who are unfamiliar take time to learn.

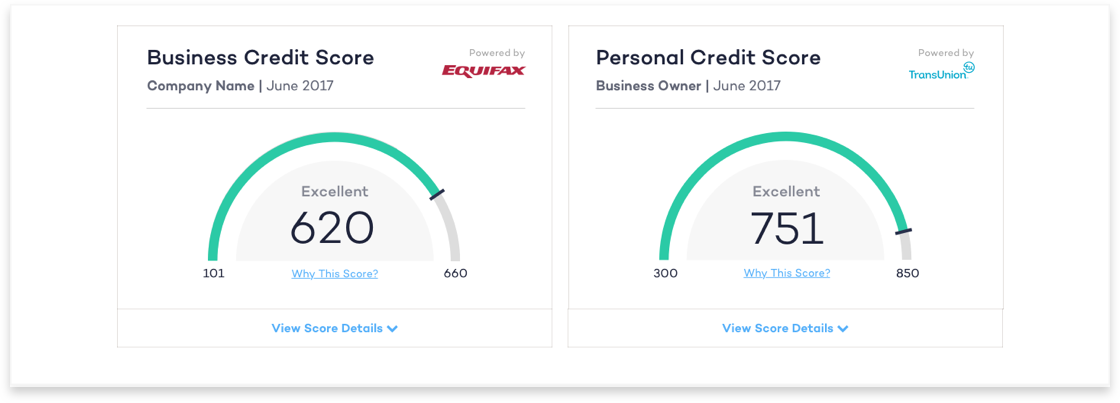

Comparing business credit against personal credit provides enough context for users to grasp the concepts.

- However, providing more information such as FAQ, tips, articles, etc... became overwhelming.

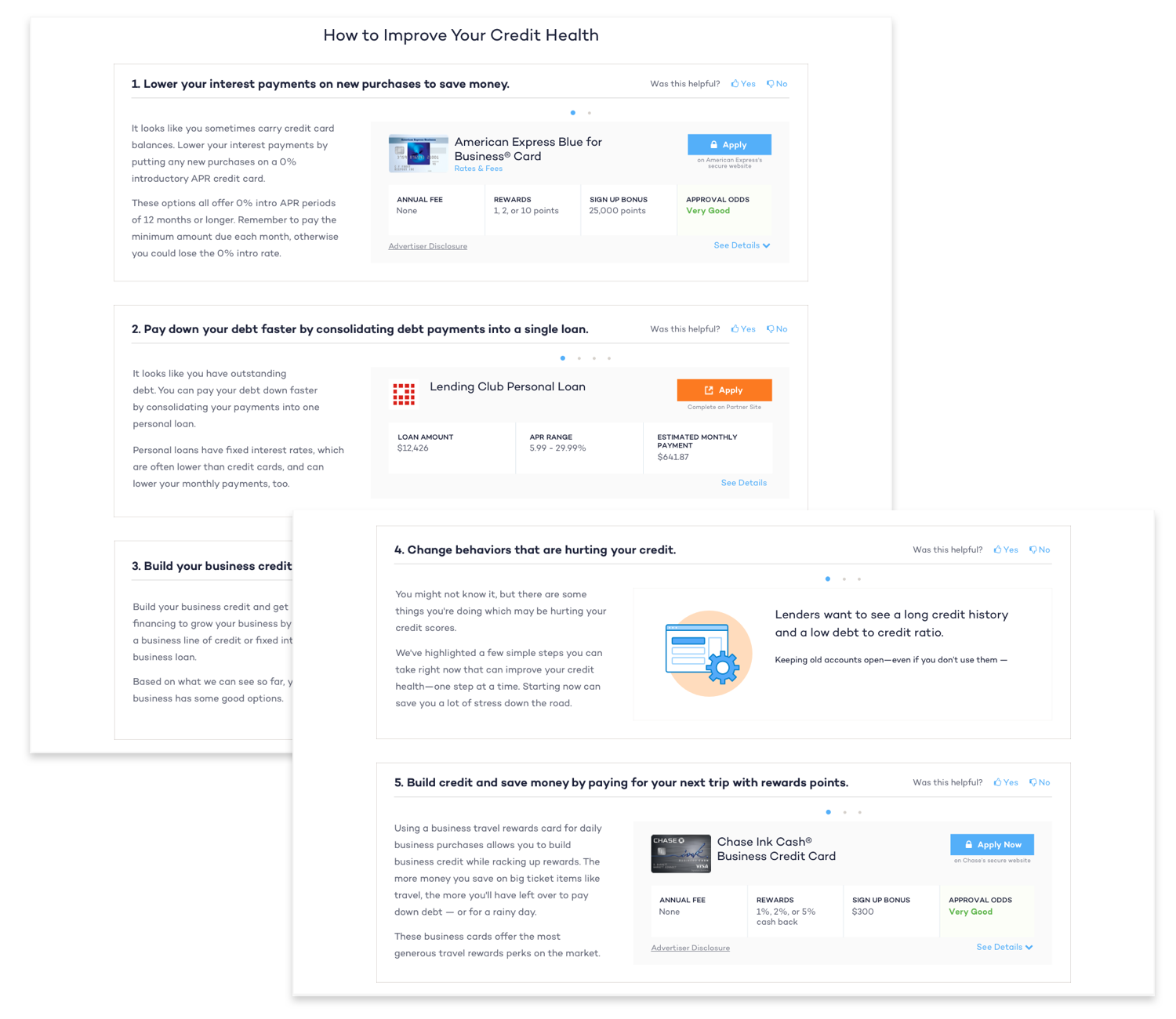

Providing guidance on what actions to take with the data shown is more powerful than simply displaying information.

- Specifically, those actions should be tailored solutions (vs. generic ads).

SOLUTION

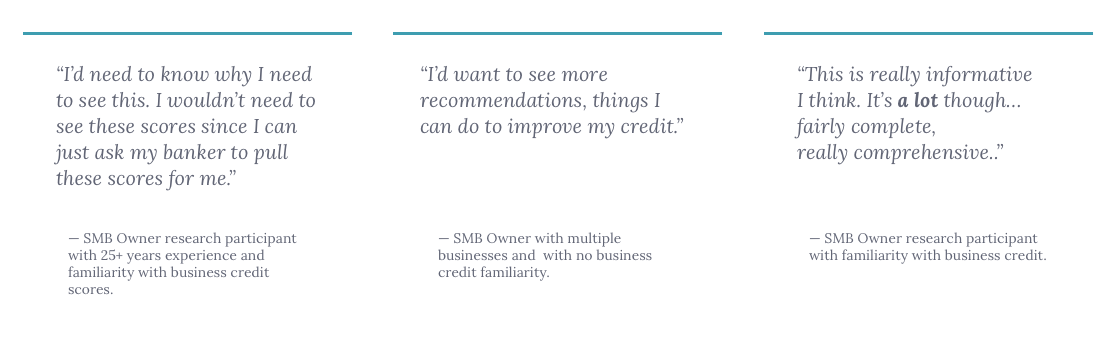

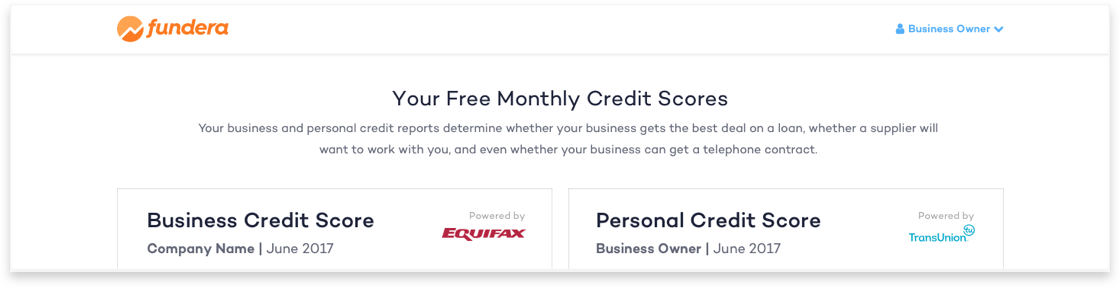

The Final Solution

With our learnings, we made the following changes for our initial launch to our funded customers.

1. Update the title copy to address what the product does and its core value to the customer.

1. Update the title copy to address what the product does and its core value to the customer.

1. Update the title copy to address what the product does and its core value to the customer.

1. Update the title copy to address what the product does and its core value to the customer.

1. Update the title copy to address what the product does and its core value to the customer.

2. Collapse the credit factors information as users knew where to look for more information if compelled to do so on the interface.

2. Collapse the credit factors information as users knew where to look for more information if compelled to do so on the interface.

2. Collapse the credit factors information as users knew where to look for more information if compelled to do so on the interface.

2. Collapse the credit factors information as users knew where to look for more information if compelled to do so on the interface.

3. Improve the recommendations page by removing “floating” call to actions.

The recommendations, initially, are based on scenarios that the user may be in and customized based on personal credit scores. In the future, we aim to base this on real-time data from the customer, so the recommendations become more tailored over time.

3. Improve the recommendations page by removing “floating” call to actions.

The recommendations, initially, are based on scenarios that the user may be in and customized based on personal credit scores. In the future, we aim to base this on real-time data from the customer, so the recommendations become more tailored over time.

3. Improve the recommendations page by removing “floating” call to actions.

The recommendations, initially, are based on scenarios that the user may be in and customized based on personal credit scores. In the future, we aim to base this on real-time data from the customer, so the recommendations become more tailored over time.

3. Improve the recommendations page by removing “floating” call to actions.

The recommendations, initially, are based on scenarios that the user may be in and customized based on personal credit scores. In the future, we aim to base this on real-time data from the customer, so the recommendations become more tailored over time.

3. Improve the recommendations page by removing “floating” call to actions.

The recommendations, initially, are based on scenarios that the user may be in and customized based on personal credit scores. In the future, we aim to base this on real-time data from the customer, so the recommendations become more tailored over time.

The Full Experience

STATUS & RESULTS

Project Launched

Project Launched

Within the first month of launch and little to no announcement of the new feature, over 250 users had signed up to view their business credit score.

As of Dec. 2017, we’ve had nearly 3,000 new personal credit sign-ups and 3,400 new business credit sign-ups.

Beginning Q1 2018, the team will be focusing on improving the service as a tool to re-engage beyond the transactional loan financing need. The initial launch with little marketing proved that people were interested. Now, it's to figure out how to drive long-term success in Fundera's mission.

REFLECTIONS

I’ve always viewed the role of the designer as the bridge between the business and user’s goals. I also consider the most influential designers are the ones who can use whatever skills they have in their design toolkit to solve any problems at hand. As I progress in my role, the opportunity for incorporating and running user feedback sessions have increasingly improved my ability to communicate my design direction.

That said, being on a small team means having to wear multiple hats. This project gave me the opportunity to become a better designer by strengthening my skills and confidence in gathering user feedback to make more user-driven informed designs.

I’ve always viewed the role of the designer as the bridge between the business and user’s goals. I also consider the most influential designers are the ones who can use whatever skills they have in their design toolkit to solve any problems at hand. As I progress in my role, the opportunity for incorporating and running user feedback sessions have increasingly improved my ability to communicate my design direction.

That said, being on a small team means having to wear multiple hats. This project gave me the opportunity to become a better designer by strengthening my skills and confidence in gathering user feedback to make more user-driven informed designs.

I’ve always viewed the role of the designer as the bridge between the business and user’s goals. I also consider the most influential designers are the ones who can use whatever skills they have in their design toolkit to solve any problems at hand. As I progress in my role, the opportunity for incorporating and running user feedback sessions have increasingly improved my ability to communicate my design direction.

That said, being on a small team means having to wear multiple hats. This project gave me the opportunity to become a better designer by strengthening my skills and confidence in gathering user feedback to make more user-driven informed designs.

I’ve always viewed the role of the designer as the bridge between the business and user’s goals. I also consider the most influential designers are the ones who can use whatever skills they have in their design toolkit to solve any problems at hand. As I progress in my role, the opportunity for incorporating and running user feedback sessions have increasingly improved my ability to communicate my design direction.

That said, being on a small team means having to wear multiple hats. This project gave me the opportunity to become a better designer by strengthening my skills and confidence in gathering user feedback to make more user-driven informed designs.